Economists agree that low, stable price inflation is good for the economy. Creating low inflation is a primary goal of monetary policy at the Federal Reserve, where policymakers are tasked with a dual mandate of “price stability” and “maximum employment.”

Today, the U.S. dollar is depreciating at a pace not seen since 1982. In just two years, from November 2020–22, the real buying power of the U.S. dollar has plummeted by 14.4%. Federal Reserve Chairman Jerome Powell acknowledged the costs of currency devaluation before Congress in June: “We understand that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation.”

But Powell and his peers venerate the broader concept of price inflation in theory and in practice, so long as the currency only loses value at a rate they deem sufficiently low. In 2012, the Federal Reserve (Fed) declared an explicit annual inflation target of 2%. Since the 1990s, the Fed has implicitly pursued the same general goal of slow and steady inflation, albeit without revealing a specific annual target.

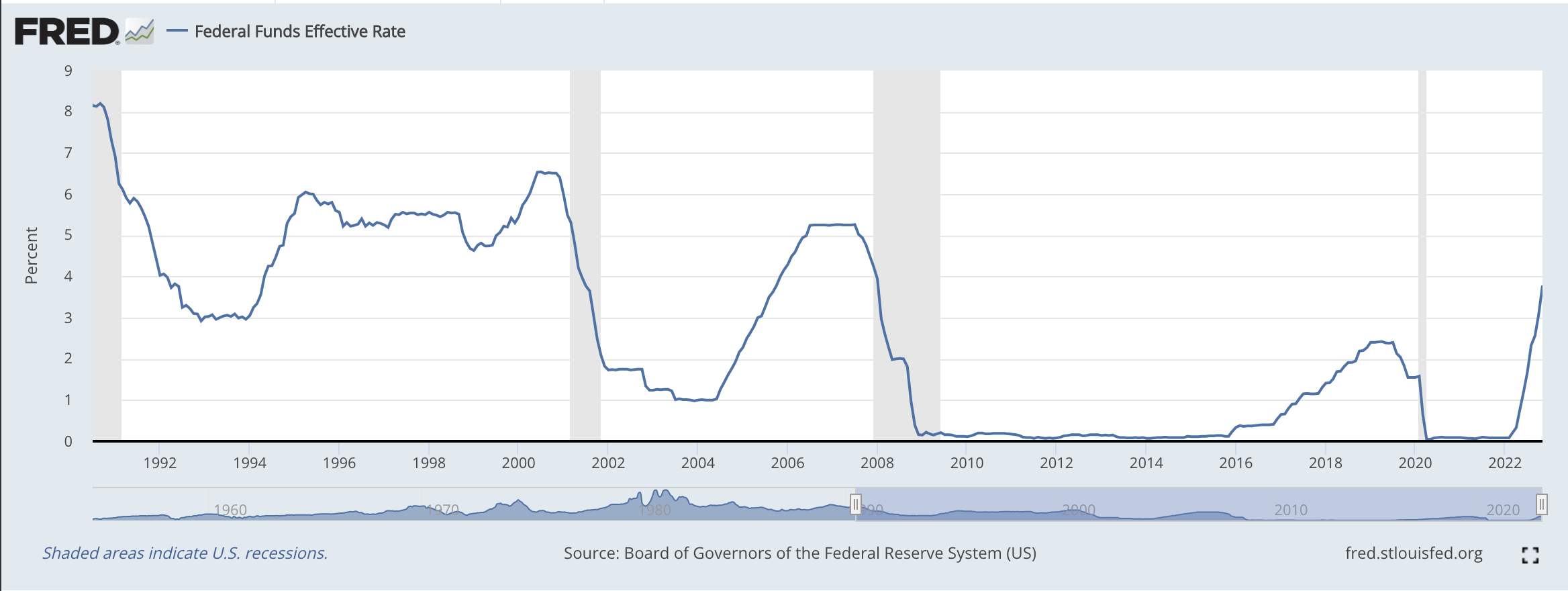

This means that if prices are rising at a rate lower than 2%, and especially if prices are dropping, the Fed will take steps to bring inflation back up, mainly by lowering interest rates to encourage more lending and spending, or by printing trillions of dollars in new money to “purchase” federal government debt. After abusing these mechanisms during the Covid era, the Fed is now rapidly reversing course – raising interest rates and selling government debt to the public – to bring down the high inflation they helped produce.

The Fed directly financed half of the unprecedented $5.1 trillion in coronavirus stimulus packages with newly-minted dollars, leading to a 35% expansion of the money supply in just 18 months. (See the chart below for a shocking visual depiction of this reckless decision.) In place of slow and subtle erosion of purchasing power over time, the Fed and Congress put the pedal of monetary stimulus to the floor.

As a result, the United States is now experiencing, as Dr. Saifedean Ammous would say, “the pleasures of Keynesian funny money.” Poor and middle-class Americans who received checks from the government have long since spent them, but are still picking up the tab with 4 years worth of inflation in the span of 1.

Just like prices, average wages are through the roof. Nominal hourly earnings increased 12.2% on average from October 2020–22. A credulous observer would applaud this development as a pay raise of epic proportions. But since those dollars also lost 14.4% of their purchasing power over the same period of time, real wages declined by 2.2% on average.

Even worse off are the millions of Americans who are “below average” and did not receive a 12.2% raise. Many are earning the same nominal wage as they did in 2020. For example, Target implemented a company-wide minimum wage of $15 per hour in July 2020. Thousands of cashiers and frontline employees, including this author, have not received a raise since, meaning that the last two years of price inflation have reduced their per-hour earnings to less than $13 in 2020 dollars. These declines will become much more pronounced if inflation remains high and the economy enters a full-fledged recession.

In their eternal quest to destroy American capitalism, progressive activists are fond of attacking America for high income inequality. Their conclusions are always the same: income inequality is the result of a free market system, fueled by greedy capitalists and corporations who exploit the working class, and must be “solved” by higher taxes. In reality, inequality is the natural result of decades of government-sponsored price inflation.

Leftists are correct that hourly wages in America have stagnated over the long run. In 1972, American workers earned an average wage of $3.88 per hour. By 2022, they were earning $27.45. Adjusting these numbers for inflation, however, reveals that hourly pay has increased by just twelve cents over the course of 50 years. Real wages have gone nowhere at all.

For this reason, progressive criticism of the federal minimum wage is also rooted in truth. Although only 0.15% of workers are still paid at the minimum of $7.25 per hour, the U.S. dollar has lost a whopping 38.9% of its value since this wage was mandated in 2009. Minimum wage workers are making the equivalent of $4.43 in 2009 dollars.

As average wages stagnate due to never-ending inflation, the rich do get richer. The share of wealth held by the top 1% of earners increased from 23.6% in 1989 to 31.9% in 2022. However, the blame for this stark reality of wage stagnation and economic disparity does not fall on its beneficiaries. By pumping the economy with endless new money and “stimulus” in pursuit of 2% annual price inflation, the Fed degrades the value of every American dollar while simultaneously propping up asset classes, like housing and the stock market. This hits poor and middle-class Americans the hardest, since they are farthest away from the money printer and have the most to lose when their money sheds its value.

Wealthy Americans understand that putting cash in the mattress, an envelope, or even a checking account is no better than shredding 2% of those dollars each year when the Fed achieves its target – or 8% (or more) when it doesn’t. Naturally, the rich hire professional money managers to park most of their wealth in assets like stocks and real estate to achieve an inflation-beating return, and even losing money in a bear market will not have a major impact on their quality of life.

The more money is printed, the more the system gives an automatic advantage to those who already own assets. For example, the S&P 500, which tracks a broad sector of the U.S. stock market, doubled in value between Trump’s first Covid stimulus bill and the summer of 2021. The median price of an American home increased by 41%.

In expectation of prices rising by 2% or more every year, everyone, not just the wealthy, is looking for the best place to stash their savings that will preserve the value of their hard-earned cash. But this status quo requires low- and middle-class Americans to take on significant risk just to save for the future. “Savings” loses all meaning and utility when your dollars are losing 2% (or 7-8%) of their value year after year. And by holding down interest rates at near-zero levels, the Fed has taken away the option of using a traditional savings account and forced us all into the inherently risky casino of the stock market.

The Fed held interest rates close to zero for most of the 2010s, shown in the chart above. As a result, the average yield for a savings account was around 0.1%. Imagine that you had parked $1,000 in a savings account from 2012 to 2021, earning 0.1% compound interest. Your money would be worth $1,009 today. But since inflation caused your dollars to lose 1/5 of their value, your savings are now effectively worth $797.11. Inflationary money means you are punished for being financially responsible; there is little choice but to accept the risk of gambling your hard-earned cash in highly volatile markets like stocks and real estate.

Many ordinary Americans put their savings in pension plans or retirement accounts that track broad sectors of the stock market. But these investments are not guaranteed even to preserve one’s initial investment, let alone to see it grow. In 2022, the average 401(k) plan has lost more than 25%; pension funds dropped by 15%.

Some Americans save up for years to make a down payment on a new home. Buying a home is often viewed as a great long-term investment strategy. But a homebuyer is always taking on the risk of a crash or a downturn in the market. Home prices can fluctuate wildly, especially if government stimulus (or lack thereof) is pumping home prices in one direction or the other. For the average American, such fluctuations can be devastating, and could lead to default and foreclosure during a 2008-style recession.

The sheer effort (and luck) required to protect wealth from inflation may be one reason why 63% of Americans live paycheck-to-paycheck. By actively promoting 2% inflation, the Fed encourages us to spend, not save, and taking on various levels of investment risk is all but mandatory to preserve one’s wealth. This precarious reality was engineered by design. How can poor Americans ever hope to get ahead, when their precious few dollars in their pockets are hemorrhaging value?

For better or for worse, the Fed has intentionally eviscerated the value of the dollar and left ordinary Americans out in the cold. Our money has shed 66% of its value in the last 20 years alone, 200% since 1983, 900% since 1962, and 3,000% since 1913, when the Federal Reserve was born.

Money is the only resource that each and every American needs – to work, to eat, to plan for the future and make the most of one’s life. Money is the tangible representation of our productive capabilities and how well we have employed our valuable, limited time. But when our money is manipulated at the whim of a handful of “experts,” poor and middle-class Americans must go to great lengths just to preserve the value of their hard-earned dollars.

With inflation at 40-year highs, our central planners at the Fed have once again miscalculated. It is high time that we demand a meaningful reevaluation of the doctrine that government-sponsored inflation, high or low, is truly good for the American people.